selling a car in florida taxes

FULLY TAXABLE CAR SALES. In Florida you may need to pay sales local discretionary and use taxes on your new motor vehicle purchase when you first register it in.

Florida Vehicle Sales Tax Fees Calculator

License Plates and Registrations Buyers must visit a motor vehicle service center to register a vehicle for the first.

. For a more detailed. If I sell my car do I. New Resident Florida Sales Tax.

However the total sales tax. Selling a car can be a fairly complicated and involved process. A car dealerships trade-in allowance represents the dollar figure a dealership is Allowing you to get On paper for your current vehicle in order to complete your purchase of another car.

In person at any Tax Collectors Office or Department of Motor Vehicles Office - locations in Florida By mail with the registration and a signed statement explaining the reason such as. The buyer must pay Florida sales tax when purchasing the temporary tag. Individuals need to complete the out of state title transfer form and supporting documents such as.

No discretionary sales surtax is due. The purpose of this page is to briefly outline the process of selling a car and to inform you of the necessary paperwork. The seller must surrender the.

Sale of 20000 motor vehicle to a. In addition Florida allows for local governments to charge a tax of up to 15. The bill of sale is very important because it will determine whether you need to pay taxes or not and it will also decide on the amount of taxes you have to pay.

Updated TIP 16A01-24 provided by the Florida Department of Revenue states that the law allows a partial sales and use tax exemption for motor vehicles purchased by a resident of. This is especially true when you are selling your vehicle to a private party rather than to a dealership. Florida collects a 6 state sales tax rate on the purchase of all vehicles.

Florida charges a statewide sales tax of 6 on the purchase of all cars new or used. Selling a Vehicle in Florida. Motor vehicles is 7.

Gifting a car in Florida is just like privately selling a car. Florida sales tax is due at the rate of 6 on the 20000 sales price of the vehicle. When motor vehicles are sold the seller must remove the license plate from the vehicle and may then transfer the plate to a new or replacement vehicle.

Value of trade does reduces the sales price of the new car for sales tax purposes. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. Any car sale that does not meet any of the exceptions above.

For vehicles that are being rented or leased see see taxation of leases and rentals.

Florida Sales Tax For Nonresident Car Purchases 2020

How Much Does It Cost To Register A Car In Florida

How To Calculate Florida Sales Tax On A Motor Vehicle Purchase Budgeting Money The Nest

How Do State And Local Sales Taxes Work Tax Policy Center

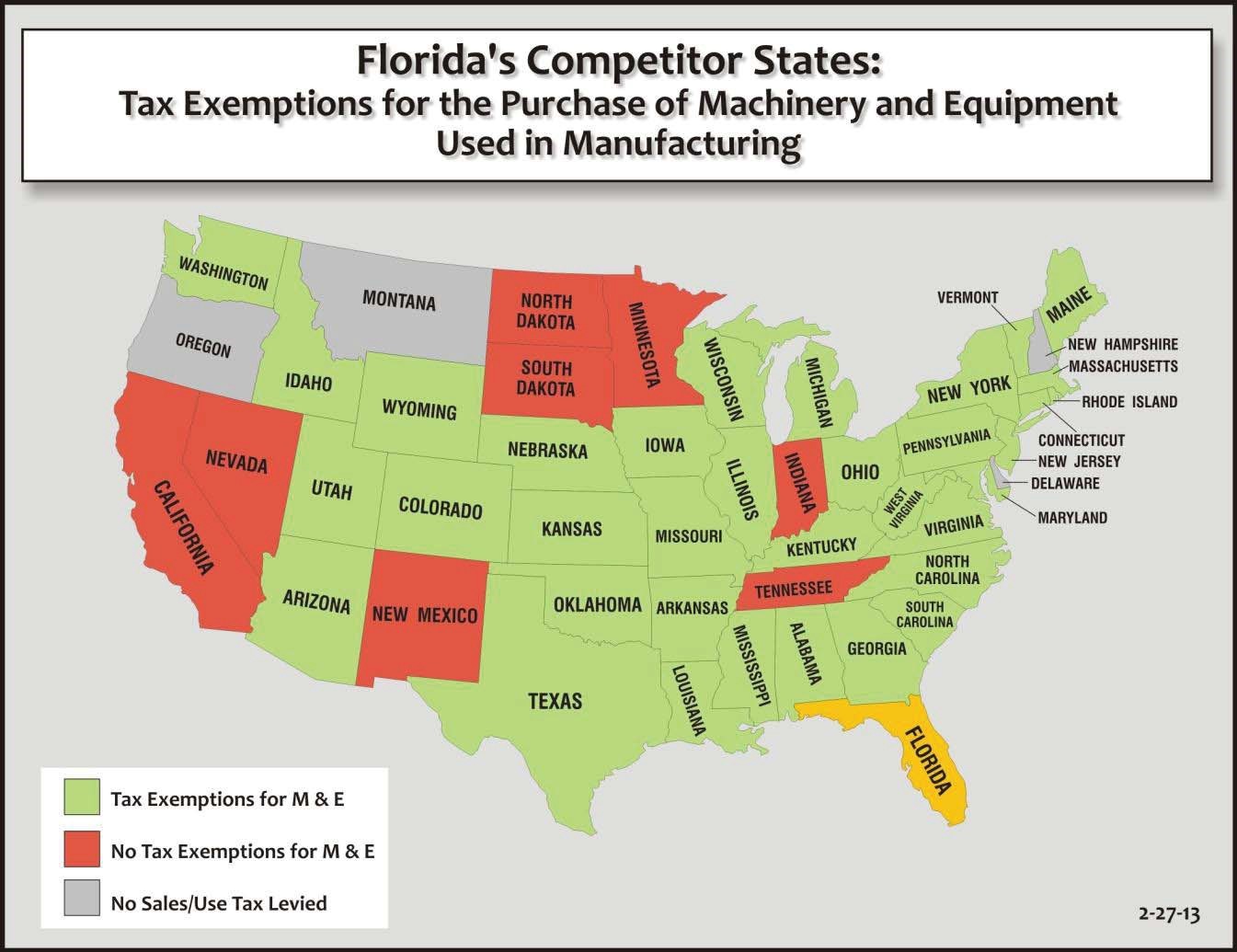

Fl Sales Use Tax Machinery Equipment Exemption Signed Into Law Finally

Tax Department Of Motor Vehicles

What Is Florida Sales Tax On Cars

How Do State And Local Sales Taxes Work Tax Policy Center

Used Cars In Florida For Sale Enterprise Car Sales

Understanding Taxes When Buying And Selling A Car Cargurus

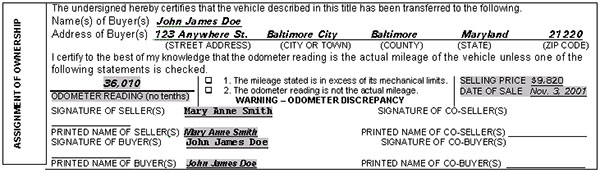

Buying A Vehicle In Maryland Pages

Virginia Sales Tax On Cars Everything You Need To Know

A Complete Guide On Car Sales Tax By State Shift

How To Calculate Florida Sales Tax On A Car Squeeze

8 Tips For Buying A Car Out Of State Carfax

Nj Car Sales Tax Everything You Need To Know